Frequently Asked Questions

What is bank account validation?

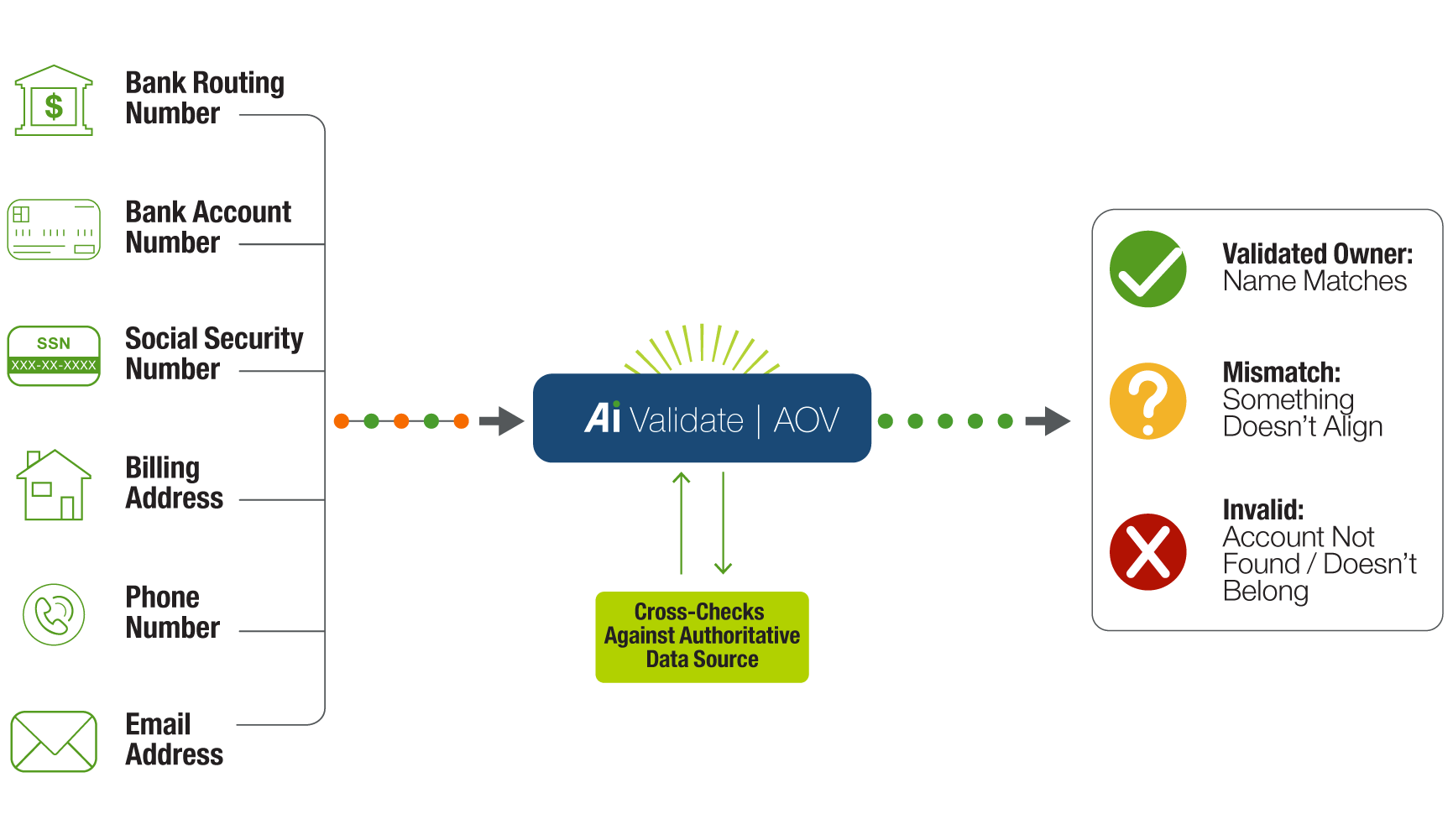

Just as prospective customers need to be accurately validated, so do the bank accounts in question. Account validation is critical for businesses that originate ACH credits and debits. An incorrect account, routing, or transit number can delay in the collection of funds, result in failed payments to suppliers, accrue fees and penalties, and damage a company’s reputation. Fast and frictionless bank account validation enables businesses to reduce both fraudulent and accidental account entries, while providing a more positive customer experience.

What is the difference between credentialed and non-credentialed account validation?

Credentialed Validation: this log-in process requires consumers to submit their internet banking username and password, providing credentials that include current balance, transaction information, validation of ownership, income validation, and more.

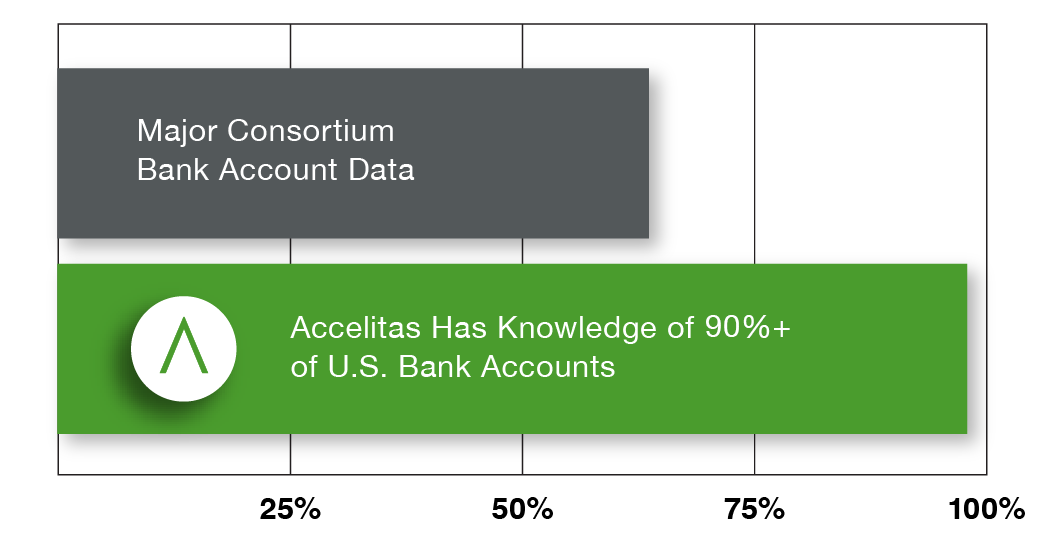

Non-Credentialed Validation: this method does not require consumers to provide their online banking credentials. While the benefit to users is a frictionless experience, a non-credentialed solution will provide less coverage; typically 60% as compared to 90%+ for credentialed coverage.

What is Nacha and the Web Debit Account Validation Rule?

The National Automated Clearing House Association, better known as Nacha, manages the development, administration, and governance of the ACH Network, the backbone for the electronic movement of money and data in the United States.

The WEB Debit Account Validation Rule took effect in March 2021. Originators of WEB debit entries have been required to use a “commercially reasonable fraudulent transaction detection system” to screen WEB debits for fraud. The Web Debit Account Validation Rule has supplemented this screening requirement to make it explicit that “account validation” is part of a “commercially reasonable fraudulent transaction detection system.” The supplemental requirement applies to the first use of an account number, or with subsequent changes to the account number, when used for WEB debit entries.

Accelitas is a Nacha Preferred Partner.