Real-time account ownership validation—no bank credentials required

Protect against identity fraud and reduce manual reviews across near-prime and underserved populations

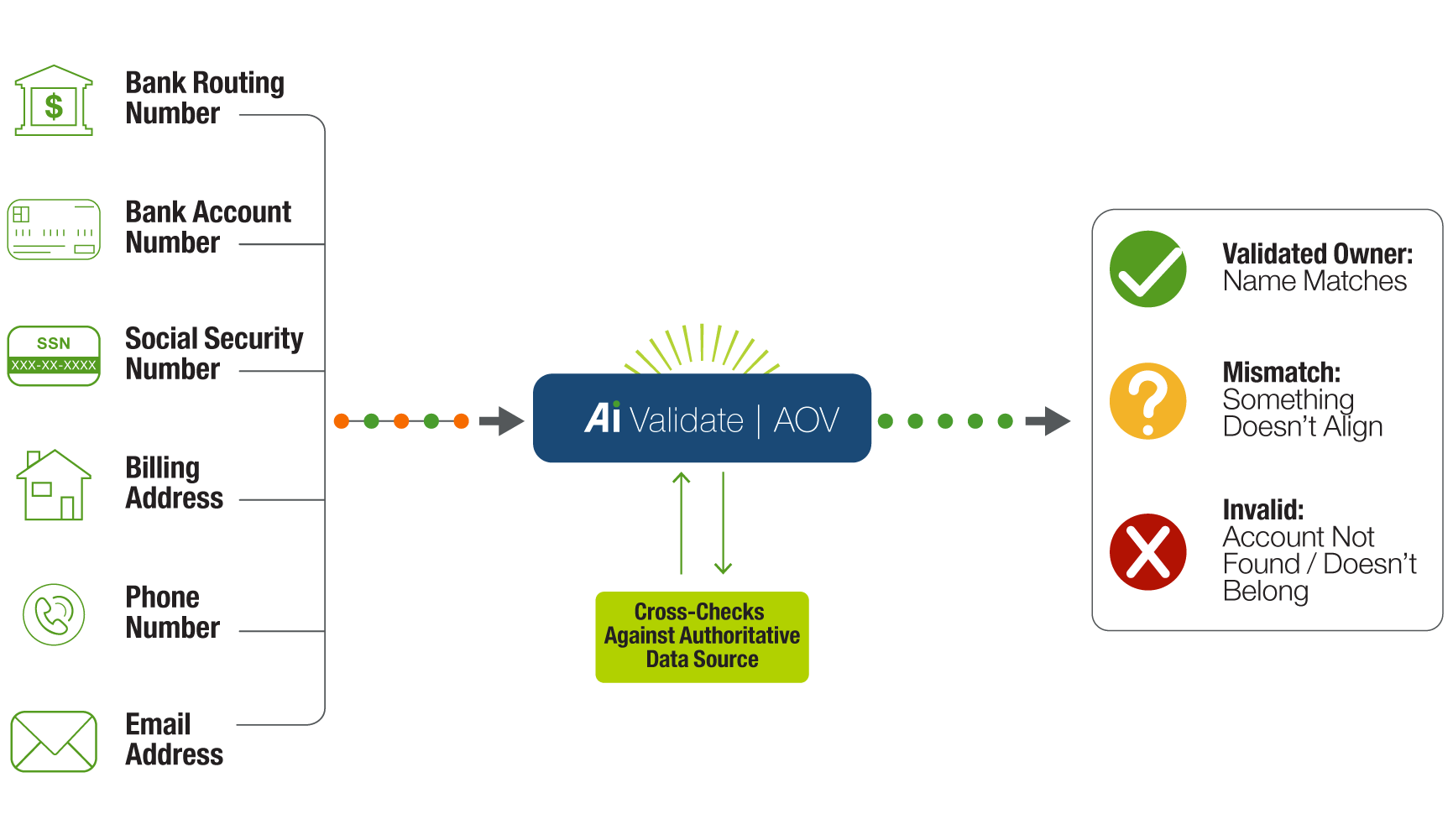

In today’s digital-first world, validating ownership—not just existence—in real-time is essential to stay ahead of fraud, improve conversions, and build trust. Ai Validate AOV confirms ownership without online-banking credentials, leveraging robust alternative data and proprietary AI/ML to deliver faster, more inclusive, and more accurate decisions at scale. Replacing legacy, incomplete checks with a modern, cloud-native platform it lowers abandonment, reduces manual reviews and costs, streamlines onboarding, and aligns with Nacha Operating Rules—all while supporting high-volume performance.

Key Benefits

Smarter risk decisions: Proprietary ML models connect PII to bank-account signals to assess ownership likelihood.

Inclusive by design: Strong coverage in near-prime/subprime (60–70%).

Frictionless: Non-credentialed experience designed to minimize drop-off.

How it works:

Submit PII + account/routing.

Receive a real-time ownership likelihood (Score 0–1,000).

Decision: Accept / Review / Decline.